13 November 2024, 11:20

DOWNLOAD THE PDF

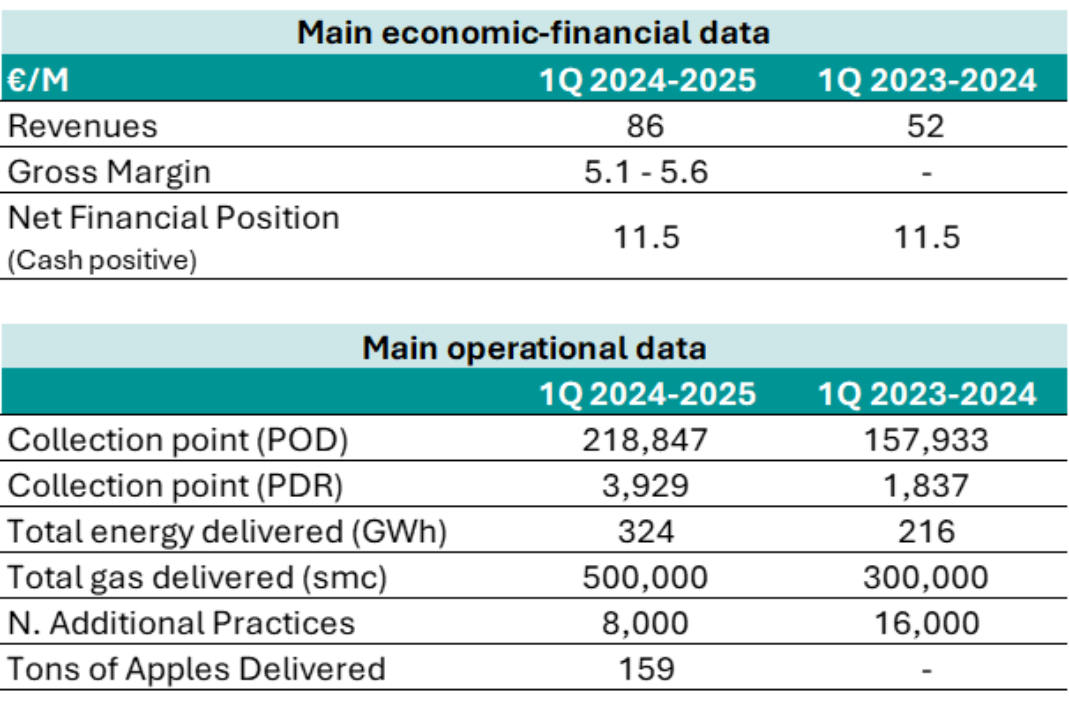

GROSS MARGIN BETWEEN € 5.1 AND € 5.6 MILLION

- Revenues at € 86 million, + 67% YoY

- Total energy supplied equal to 324 GWh, +50% YoY

- Total gas supplied equal to 500,000 smc, +79% YoY

- Net Financial Position (cash positive) at € 11.5 million, unchanged compared to 30 June 2024

- Total collection points equal to 223 thousand, +39% YoY

Saluzzo (CN), 13 November 2024 – eVISO S.p.A. (simbolo: EVISO) – COMMOD-TECH company, listed on the EGM, with a proprietary artificial intelligence infrastructure that operates in the raw materials sector (electricity, gas, apples) – communicates the main KPIs and revenues relating to the 3 months of the period July 2024–September 2024, not subject to audit.

Revenues reached €86 million, up 67% compared to the same quarter of the previous year. This significant increase is attributable to the effective expansion of the customer base and the commercial strategies implemented.

In the first quarter of the 2024-2025 financial year (July-September 2024), eVISO maintained a solid growth path, with all key KPIs increasing by double digits. The 39% increase in collection points, which reached 223 thousand, together with a growth in energy supplied to 324 GWh (+50% compared to the previous year) and gas supplied, which reached 500 thousand smc (+79% YoY), allowed eVISO to achieve, in just 3 months, a Gross Margin between €5.1 million and €5.6 million (it should be noted that in the first half of 2023-2024, before eVISO began communicating quarterly data, the Gross margin had stood at €8.3 million).

Gianfranco Sorasio, CEO of eVISO, commented: “In the quarter just ended, EVISO recorded revenues close to the threshold of € 1 million per day, adding up to € 86 million in total, up 67% compared to the same quarter last year. The Gross Margin settled in a window between € 5.1 million and € 5.6 million, which, when compared to the € 8.3 million of the entire first half of 2023-2024, shows a YoY growth of over 30%. These numbers demonstrate eVISO’s ability to attract new customers, also thanks to the expansion of the sales network”.

KPI BY BUSINESS SEGMENT FOR THE PERIOD JULY 2024 – SEPTEMBER 2024

POWER

The collection points (POD) recorded an increase of +39% (compared to the 157,933 PODs managed in the period July 2023 – September 2023) reaching 218,847, of which 22 thousand direct and 196 thousand managed by the 96 resellers associated with eVISO. The number of resellers represents a share of 14% of the total free market sales operators registered in Italy (704) in the List of Electricity Sellers (EVE) drawn up by the Ministry of the Environment and Energy Security updated as of 09.30.2024.

The total energy supplied is equal to 324 GWh, up 50% compared to the 216 GWh of the period July 2023 – September 2023, of which 227 GWh related to the reseller channel (149 GWh in the period July 2023 – September 2023) and 96 GWh addressed to the direct channel (68 GWh in the period July 2023 – September 2023). The increase in energy supplied was positively influenced by the strengthening of the eVISO commercial distribution network.

GAS

Total gas supplied reached approximately 500 thousand smc smc (standard cubic meter), up 79% compared to 300 thousand smc in the period July 2023 – September 2023. Most of the gas supplied is attributable to direct customers, as resellers have only recently entered eVISO’s customer portfolio.

Total collection points (PDR) are equal to 3,929 and have recorded an increase of +114% compared to the 1,837 PODs managed in the period July 2023 – September 2023. 97% of the PDRs recorded in the period are attributable to direct customers.

It should be noted that the gas volumes combined with eVISO in the month of October alone, as communicated by the SII, exceeded 10 million smc, with over 4,000 delivery points.

ACCESSORY SERVICES

The accessory practices subject to invoicing were approximately 8,000 compared to the approximately 16,000 accessory practices provided in the period July 2023 – September 2023. The reduction in practices towards the reseller channel is attributable, as already communicated, to the resolution, introduced from 1 December 2023, where ARERA, the sector authority, has established that some practices must be managed independently by the commercial counterpart (reseller).

FRESH APPLES

In the first 3 months of 2024-2025, 159 tons of apples were delivered (average price €247/ton – industrial product). The turnover settled at €58 thousand.

In terms of product liquidity available on the SMARTMELE exchange platform, as of September 30, 2024, the tons with limit price orders on the platform were approximately 84,000.

eVISO has signed an agreement with Seed Group, a company of the Private Office of Sheikh Saeed bin Ahmed Al Maktoum, to expand the Smartmele project on a global scale, starting from the Gulf countries.

NET FINANCIAL POSITION

The Net Financial Position is positive (cash) for € 11.5 million, compared to a positive Net Financial Position of approximately € 11.5 million (cash) at 30 June 2024 and a positive Net Financial Position of approximately € 5.3 million (cash) at 30 September 2023.

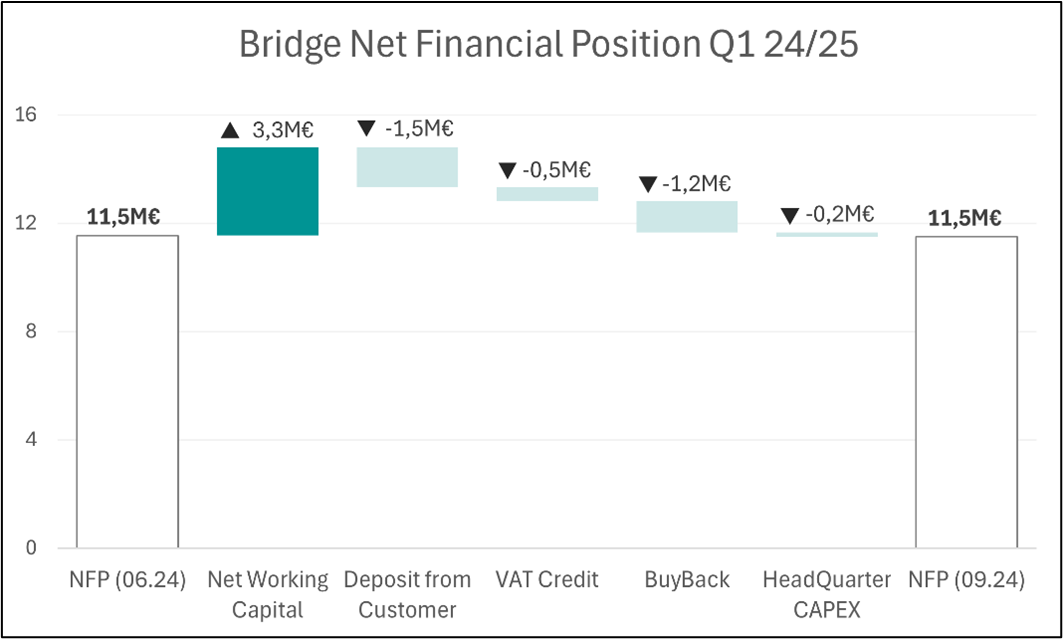

The NFP from 30 June 2024 to 30 September 2024 was affected as follows:

- positively by € 3.3 million relating to the improvement in working capital;

- negatively by the reduction of € 1.5 million in security deposits, following the realignment of guarantee requests to the price of energy;

- negatively by € 0.5 million in VAT credit;

- negatively by the increase in buyback activity of approximately € 1.2 million;

- negatively by the increase of € 0.2 million relating to the investment in the property owned.

For ease of reading, the graph below represents the elements that contributed to the change in the Net Financial Position in the period, in positive terms in case of cash generation and in negative terms in case of cash absorption.

Graph summarizing the trend of the Net Financial Position from 30 June 2024 to 30 September 2024, highlighting the items that generated or absorbed cash.

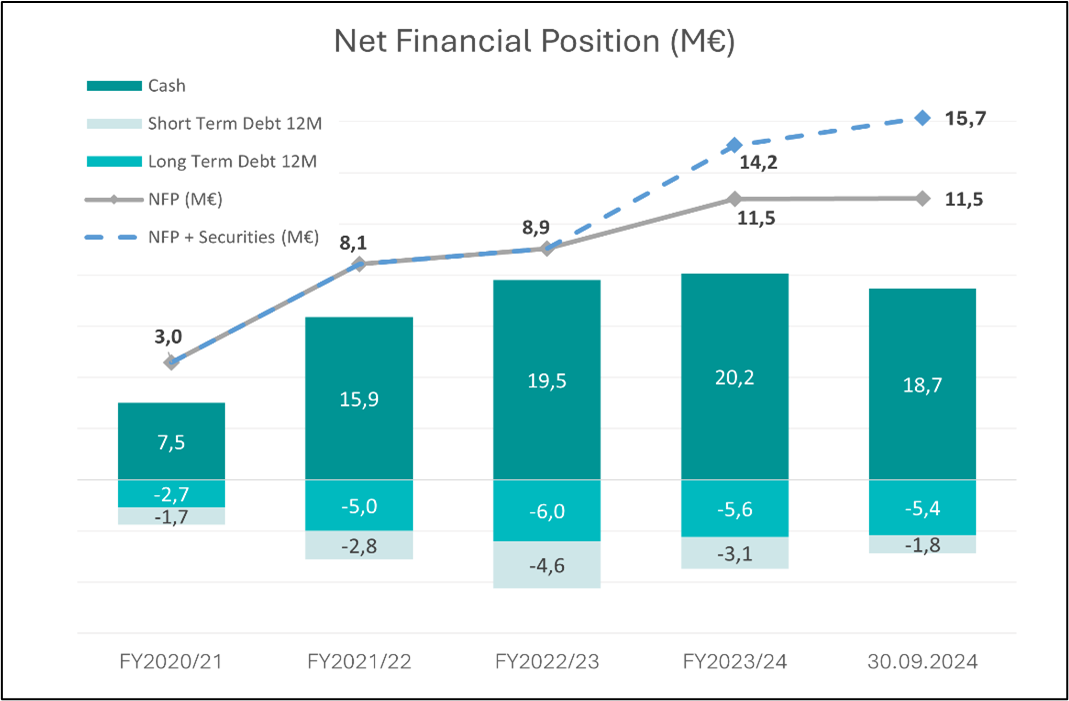

Below is a graph highlighting the composition of the Net Financial Position and its evolution[1]:

Chart illustrating the composition of the Net Financial Position from FY 2020-21 to 1Q 2024-25, highlighting the debt and cash components and the trend of the PFN and of the “PFN + Securities”. The securities item includes the value of the 869,761 treasury shares; of these, the 500,000 shares of the stock option plan are prudentially valued at the exercise price (€4) and for the remaining number of 369,761 shares at the market value as of 30 September 2024 (€5.82)

***

Below is a table summarizing the main KPIs for the period July 2024-September 2024[2].

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.

[1] In the graph, the line relating to “NFP + Securities” highlights the correction of the Net Financial Position taking into account the Securities, which are not included in the calculation of the PFN following the Italian accounting principles. To calculate this value, treasury shares and other non-material options were added to the PFN of the period.

[2] The Gross Margin data for 1Q 23-24 is not reported in the table as the Company has started to communicate the KPIs on a quarterly basis starting from 2024.