12 November 2025, 19:01

DOWNLOAD THE PDF

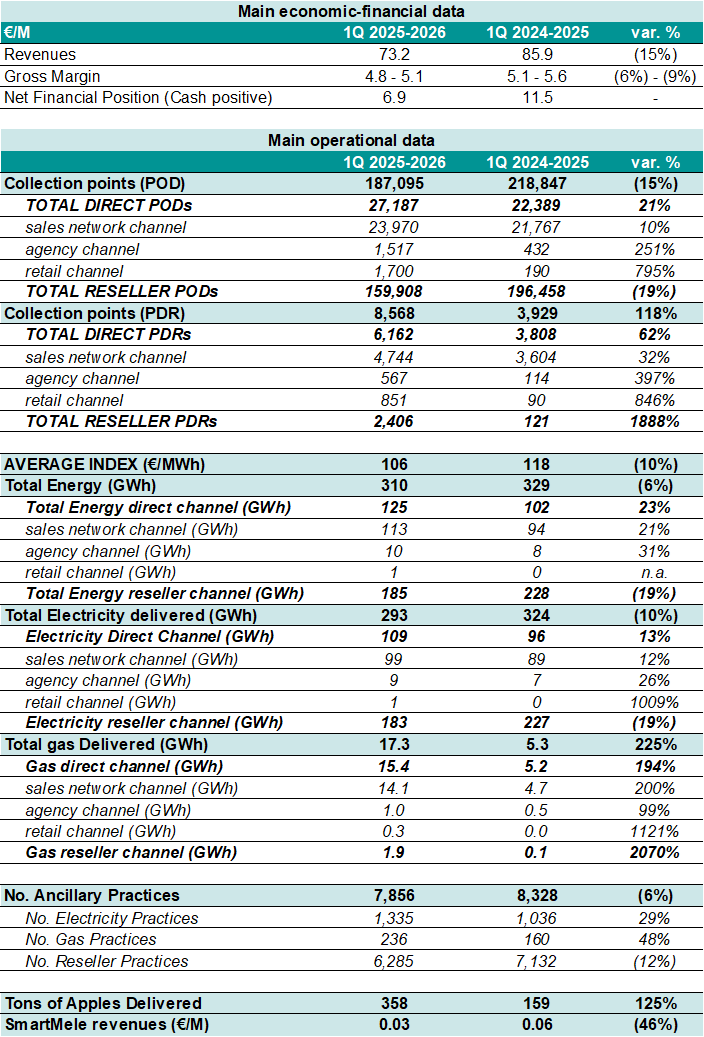

RESULTS FOR THE PERIOD ARE AFFECTED BY THE TREND OF THE AVERAGE ENERGY INDEX (-10%)

THE DIRECT CHANNEL GROWS, THE HIGHEST-MARG SEGMENT

REORGANIZATION OF THE RESELLER NETWORK

STONG GROWTH IN THE GAS SEGMENT

- Revenues of €73.2 million, -15% YoY

- Total electricity and gas energy of 310 GWh[1], -6% YoY

- Electricity supplied to the direct channel of 109 GWh, +13% YoY

- Electricity supplied to the reseller channel of 183 GWh, -19% YoY

- Gas supplied of 17.3 GWh, +225% YoY

- Preliminary gross margin between €4.8 million and €5.1 million (-6%/-9% YoY)

- Net financial position (cash positive) of €6.9 million, compared to a net financial position (cash positive) of €9.2 million at June 30, 2025 (of which €1.1 million from share buyback)

Saluzzo (CN), 12 November 2025 – eVISO S.p.A. (symbol: EVISO) – technology company, listed on the EGM, operating in the electricity, gas and fruit sectors – communicates the main KPIs and revenues relating to the 3 months of the period July 2025 – September 2025, not subject to auditing.

The period’s results were impacted by a declining trend in the average energy index[2] (electricity and gas), which decreased by 10% YoY (from €118/MWh in the period July 2024 – September 2024 to €106/MWh in the period July 2025 – September 2025), due to increased energy production from renewable sources, stable gas prices, and less pressing energy demand compared to 2024. At the same time, the results confirm eVISO’s ability to consolidate and develop even its most recent businesses, with strong growth in the Gas segment (+225%).

Revenues amounted to €73.2 million, a 15% decrease compared to the same period of the previous year, primarily due to the trend in the average index and the dynamics outlined below:

- significant growth in the direct channel’s electricity segment, with a 13% increase in energy delivered, equal to 109 GWh, and a 21% increase in PODs, which totaled 27,187. This result is consistent with the company’s strategy of focusing on the direct channel, a segment characterized by higher margins and stable customer relationships;

- a contraction in the electricity segment of the resellers channel, with a 19% decline in energy delivered, equal to 183 GWh, and a decrease in the number of point of delivery (POD) managed by the 101 resellers associated with eVISO, which now stands at 160,000 (-19% YoY). This trend is attributable to two sets of factors, both exogenous and endogenous. Regarding the first factor, eVISO already decided at the beginning of the year to maintain its strategic focus on the gross margin. Therefore, in a period of intense competition, eVISO gave priority to other, more profitable sales channels. Overall, the gross margin as a percentage of (total) revenues increased to 6% – 7.0%, up 10% compared to the same period of the previous year. Regarding the second factor, the results achieved partially reflect the effects of a significant internal reorganization initiated during the year. After a management turnaround at the start of the year, a period of strengthening the reseller team, currently composed of five employees, has begun, with the opening of new sales and administrative positions.

- Positive performance in the gas segment, which during the period saw a 225% increase in total gas supplied, equal to 17.3 GWh, and a 118% increase in the number of total PDRs, reaching 8,568. This result confirms eVISO’s ability to consolidate and grow even the most recent segments of its business, such as gas, effectively applying its distinctive solutions and expertise.

The above-described effects contributed to generating a Gross Margin of between €4.8 million and €5.1 million (€5.1 million – €5.6 million in the period July 2024 – September 2024), with a percentage incidence on revenues of between 6.6% and 7.0%, up 10% compared to 5.9% – 6.5% in the period July 2024 – September 2024.

Lucia Fracassi, CEO of eVISO, commented: “The quarterly results, despite being impacted by the normalization of energy prices and increasing competition in the reseller channel, demonstrate the company’s ability to decisively grow the strategic segments of the direct and gas channels. Strengthening these areas, combined with a constant focus on operational efficiency, allows us to continue consolidating and developing our businesses. We promptly responded to the negative performance of the electricity reseller channel by implementing all necessary measures to resume growth. We will continue to invest in innovation and higher value-added services, with the aim of generating sustainable value for our stakeholders and further strengthening eVISO’s positioning in the markets in which we operate”.

KPIS BY BUSINESS SEGMENT FOR THE PERIOD JULY 2025 – SEPTEMBER 2025

POWER

The total electricity supplied is equal to 293 GWh, a 10% decrease compared to the 324 GWh in the period July 2024 – September 2024, of which 183 GWh relates to the reseller channel (a 19% decrease compared to the 227 GWh in the period July 2024 – September 2024) and 109 GWh directed to the direct channel (a 13% increase compared to the 96 GWh in the period July 2024 – September 2024).

The collection points (POD) recorded a 15% reduction (compared to the 218,847 PODs managed in the period July 2024 – September 2024) reaching 187,095, of which 27 thousand direct (+21% YoY) and 160 thousand (-19% YoY) managed by the 101 resellers associated with eVISO. The number of resellers represents a share of approximately 13% of the total number of free market sales operators registered in Italy (786) in the List of Electricity Sellers (EVE) drawn up by the Ministry of the Environment and Energy Security updated as of 09.30.2025. Furthermore, the total number of PODs includes a share of retail customers (1,700 PODs) approximately nine times higher than the 190 supply points in the period from July 2024 to September 2024, consistent with the company’s strategy to penetrate this segment as well.

It should be noted that electricity volumes in the reseller channel combined with eVISO in November 2025, as communicated by the SII (the public body that manages information flows relating to the electricity and gas markets), amounted to 767 GWh.

GAS

Total gas delivered stood at 17.3 GWh, up 225% compared to the 5.3 GWh for the period July 2024–September 2024. The direct channel is also the dominant market during this period, with 15.4 GWh.

The total collection points (PDRs) amounted to 8,568, an increase of 118% compared to the 3,929 PDRs managed in the period July 2024–September 2024, of which 6,162 were for the direct channel and 2,406 for the reseller channel.

It should be noted that the gas volumes in the reseller channel combined with eVISO in November, as communicated by the SII (the public body that manages information flows relating to the electricity and gas markets), amounted to approximately 23 GWh, up 8% compared to the approximately 21 GWh combined in September 2025.

ANCILLARY SERVICES

Ancillary services subject to invoicing totaled 7,856, compared to approximately 8,328 provided between July 2024 and September 2024. The change in procedures is attributable to the ARERA resolution, introduced on December 1, 2023, which regulated that the most frequent ancillary procedures must be managed independently by the reseller (commercial counterpart), thus excluding the possibility of them being performed by the wholesaler.

FRUITS

In the first three months of FY 2025, the start of the harvest season for the Northern Hemisphere, 278 tons of peaches and 73 tons of apples, primarily for processing, were delivered for the first time under the SMARTMELE project, representing a 125% YoY growth.

***

NET FINANCIAL POSITION

The Net Financial Position (cash) is positive by €6.9 million, compared to a positive Net Financial Position of approximately €9.2 million (cash) at June 30, 2025, and a positive Net Financial Position of approximately €11.5 million (cash) at September 30, 2024.

The Net Financial Position (NFP) from June 30, 2025, to September 30, 2025, was affected as follows:

- €0.3 million reduction in deposits paid by resellers;

- €0.2 million increase in deposits paid to energy suppliers;

- payment of the annual and recurring adjustment to Terna S.p.A. of €3.7 million;

- share buyback of €1.1 million.

***

Below is a table summarizing the key KPIs for the period July 2025 – September 2025.

[1] Value calculated as the sum of the electricity delivered and the gas supplied, the latter converted into GWh according to the standard formula defined by ARERA.

[2] Average index: average price of electricity and natural gas on the total economic value of electricity and natural gas delivered.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.