11 February 2026, 15:37

READ THE PRESS RELEASE

STRONG GROWTH IN THE GAS SEGMENT (+105%) AND DEVELOPMENT OF THE DIRECT CHANNEL (+28%)

STRONG GROWTH IN COMBINED ELECTRICITY & GAS VOLUMES (FEBRUARY 2026) AT 1650 GWh, +150 GWh IN TWO MONTHS DRIVEN BY THE RESELLER CHANNEL

- Half-year gross margin between Euro 10.0 million and Euro 10.8 million (-6%/+2% YoY)

- Total energy (electricity and gas) supplied equal to 669 GWh, +2% YoY

- Average energy, electricity, and gas raw material index at €102/MWh, -13% YoY

- Revenues of Euro 155.8 million, -8% YoY

- Net financial position (cash) of Euro 9.5 million, compared to a NFP (cash) of Euro 9.2 million at June 30, 2025

Saluzzo (CN), 11 February 2026 – the Board of Directors of eVISO S.p.A. (symbol: EVISO) – technology company, listed on the EGM, operating in the electricity, gas and fruit sectors –met today and examined the preliminary unaudited half-year results for the period July 1, 2025 – December 31, 2025, which have not been audited.

The results for the half-year summarize two main development dynamics.

The first concerns the growth of the direct sales channel, supported by investments in commercial infrastructure made in the previous year. During the period, total energy volumes (electricity and gas) in the direct channel grew by +28% YoY, with positive contributions from all the main commercial channels: sales network channel (+23%), agencies (+59%), retail (+618%) and digital channel (50x). The development of the gas segment in the reseller channel follows the same positive trajectory, with a 20X YoY increase.

The second dynamic concerns the electricity segment in the reseller channel: an initial phase of deliberate short-term contraction of the channel implemented in the previous financial year to improve the quality of resellers, i.e., an explicit trade-off on less profitable volumes (-15% YoY), also in view of the significant regulatory changes at the end of 2025, was followed, starting in November 2025, by a phase of vigorous recovery in volumes. In particular, in February 2026, annual electricity volumes in the reseller channel combined with eVISO increased by 113 GWh (+14%) to a record 902 GWh, compared to December 2025 volumes (see press release of December 12, 2025), which were up 22 GWh (+3%) compared to November 2025.

Lucia Fracassi, CEO of eVISO, commented: “The investments made resulted in significant increases in volumes delivered in the July-December 2025 period: +28% in the direct channel (electricity and gas) and +105% in gas across all channels. In the reseller channel, the strategy saw an initial phase of trade-off in power volumes (-15% YoY) with lower margins, followed by a second phase of vigorous volume growth. The annual volume data combined with eVISO in February 2026 are extremely encouraging: +113 GWh of power volumes on the reseller channel compared to December 2025, reaching 902 GWh; +150 GWh of electricity and gas across all channels, reaching 1650 GWh. The acceleration in recent months represents a solid basis for growth”.

At the national level, the first half of the year saw a reduction in both the average price of electricity (PUN), down 9% YoY (€112/MWh), and the average price of gas, down 18% YoY (€34/MWh). In this context, eVISO’s average energy index (electricity and gas) fell by -13% YoY.

Against this backdrop, revenues amounted to Euro 155.8 million, down 8% YoY.

Electricity – direct channel

Electricity supplied through the direct channel increased by 16% to 222 GWh, accompanied by a 23% increase in the number of PODs, which reached 28,328 units. This trend is consistent with the investment strategy for the direct channel, which is characterized by higher margins and more stable customer relationships. All commercial channels showed double-digit growth compared to the same period of the previous year: +14% sales network channel, +37% agencies, +704% retail, and +3,005% digital channel.

Electricity – reseller channel

The reseller channel saw a selective reduction in energy supplied of 15%, equal to 361 GWh, accompanied by a realignment of the portfolio of PODs managed by the 102 resellers linked to eVISO, which stood at 163,000 units (-14% YoY). In particular, in February 2026, electricity volumes in the reseller channel associated with eVISO, as reported by the Integrated Information System (SII), increased by 113 GWh (+14%) to a record 902 GWh, compared to December 2025 volumes (see press release of December 12, 2025), which were up 22 GWh (+3%) compared to November 2025.

Gas segment

Total gas supplied amounted to 85.2 GWh, up +105% YoY, with a +169% increase in the number of total PDRs, reaching 11,630 units. Growth was driven in particular by the reseller channel, which recorded a 20X YoY increase. The direct sales channel showed an overall increase of 80%, consisting of +68% commercial network, +176% agencies, and +578% retail.

Overall, these dynamics contributed to the generation of a gross margin of between Euro 10.0 million and Euro 10.8 million, representing between 6.3% and 6.9% of revenues, compared to 6.3% in the period July–December 2024.

KPIS BY BUSINESS SEGMENT FOR THE PERIOD JULY 2025 – SEPTEMBER 2025

POWER

Total electricity supplied amounted to 583 GWh, down 5% compared to 615 GWh in the period July 2024 – December 2024. Specifically, 361 GWh relate to the reseller channel (-15% compared to 424 GWh in the period July 2024 – December 2024), while 222 GWh relate to the direct channel (up 16% compared to 191 GWh in the period July 2024 – December 2024).

In February 2026, the volumes of electricity combined with eVISO, as reported by the Integrated Information System (SII) – the public body that manages information flows relating to the electricity and gas markets – confirmed the growth trend driven by commercial investments, reaching a record value of 1,422 GWh, of which 902 GWh related to the reseller channel and 520 GWh to the direct channel.

There are 190,852 points of delivery (PODs), down 10% from 213,021 PODs in the period July 2024 – December 2024. Specifically, 28,000 PODs relate to the direct channel (+23% YoY) and 163,000 to the reseller channel (-14% YoY). The 102 resellers associated with eVISO represent approximately 13% of the total number of active sales operators in the free market (782) according to the Ministry of the Environment and Energy Security’s List of Electricity Vendors (EVE) updated on December 31, 2025. The total number of PODs includes 1,853 retail customers, more than 9x higher than the 205 PODs in the period July 2024 – December 2024, in line with the strategy to penetrate this segment.

GAS

Total gas supplied amounted to 85.2 GWh, up 105% compared to 41.5 GWh in the period July 2024 – December 2024. Once again, the direct channel represented the dominant market with 73.9 GWh (+80% YoY). The percentage of gas in the total volumes supplied by eVISO increased from 6% to 13%.

The total number of collection points (PDR) is 11,630, up +169% compared to the 4,322 PDRs in the period July 2024 – December 2024, of which 6,803 are for the direct channel and 4,827 are for the reseller channel. On a quarterly basis, PDRs in the reseller channel show a significant increase of 2,421 units (+101%).

In February 2026, gas volumes linked to eVISO, as reported by SII, reached a record value of 231 GWh, of which 48 GWh related to the reseller channel (+228% compared to September 2025) and 183 GWh related to the direct channel (+14% compared to September 2025).

ANCILLARY SERVICES

There were 16,358 ancillary services subject to invoicing, substantially in line with the 16,459 recorded in the period July 2024–December 2024. The change is attributable to the entry into force of the ARERA resolution, which provides for the reseller to manage the most frequent ancillary procedures independently.

FRUITS

In the first half of the 2025–2026 financial year, 285 tons of peaches and 450 tons of apples were delivered, mainly for industrial use, with an overall reduction of 5% YoY associated with a weak year-end in the national market in the apple segment.

***

NET FINANCIAL POSITION

The Net Financial Position is positive (cash) at Euro 9.5 million, compared to Euro 9.2 million at June 30, 2025, and Euro 11.3 million at December 31, 2024. A detailed bridge of the main changes will be prepared following the approval of the half-yearly financial report on March 25, 2026.

***

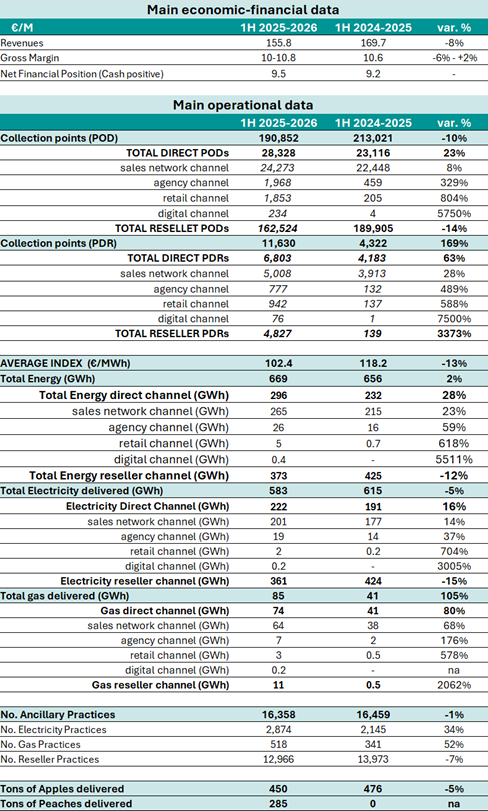

Below is a table summarizing the main KPIs for the period July 2025 – December 2025:

***

The Board of Directors of eVISO S.p.A. also announces the appointment of Ms. Laura Milanesio as Investor Relations Officer.

Ms. Milanesio, working in synergy with CFO Ms. Berardi and the team of executives and directors at eVISO, will strengthen relations with the national and international financial community.

To the best of the Company’s knowledge, as of today, Ms. Laura Milanesio does not hold any ordinary shares in eVISO S.p.A.

***

The above data are of a management nature and are not subject to audit. The complete financial data will be published, as per the Company’s financial calendar, following approval by the Board of Directors, scheduled for Wednesday, March 25, 2026.

The Company will present the preliminary financial data to the financial community via a webinar on Thursday, February 12, 2026, at 11:00 a.m. CET.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.