29 August 2024, 12:01

DOWNLOAD THE PDF

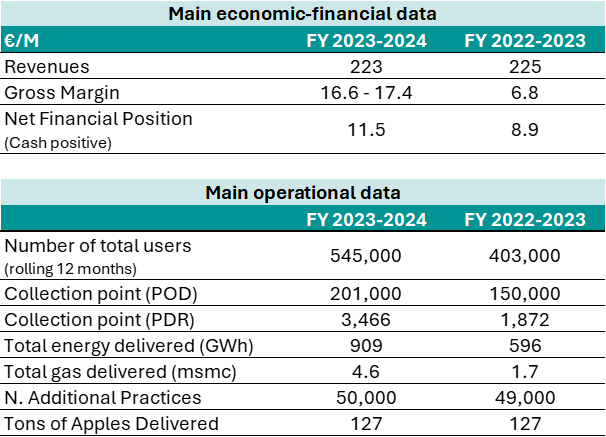

Preliminary annual Gross Margin between €16.6 million and €17.4 million (+155% compared to €6.8 million in the previous financial year)

- Total energy delivered equal to 909 GWh, up 52% YoY

- Total gas delivered equal to 4.6 million smc, up 170% YoY

- Net Financial Position (cash positive) at €11.5 million, up from €5.4 million (cash positive) at 30 March 2024 and €8.9 (cash positive) million at 30 June 2023

- Turnover at €223 million, substantially stable YoY

Saluzzo (CN), 29 August 2024 – The Board of Directors of eVISO S.p.A. (simbolo: EVISO) – COMMOD-TECH company, listed on the EGM, with a proprietary artificial intelligence infrastructure that operates in the raw materials sector (electricity, gas, apples) – met today and examined the preliminary results relating to the period July 2023 – June 2024, not subject to legal audit.

The annual indicators show 12 months of accelerating growth compared to previous years: the Gross Margin for the period July 2023 – June 2024 is between € 16.6 million and € 17.4 million, marking an increase of approximately 2.5X compared to the € 6.8 million of the previous year; the total electricity supplied increased by 52% (reaching 909 GWh); gas saw a growth of 170% (4.6 million smc).

Despite a 57% reduction in energy costs compared to the previous year (the Single National Price dropped from €247/MWh in the period July 2022 – June 2023 to €106/MWh), the 52% increase in electricity volumes and 170% in gas volumes allowed us to reach €223 million in turnover.

eVISO has demonstrated its ability to transform the infrastructure capacity developed during the energy price crisis (2021 – 2023) into industrial capacity, managing to manage a 52% increase in volumes in the energy segment in a single year and at the same time increasing margins by 155%.

Gianfranco Sorasio, CEO of eVISO, commented: “eVISO’s value creation model is based on two pillars: value chain automation with proprietary AI infrastructure and cash generation. Preliminary results indicate that Gross Margin increased by approximately 155% compared to €6.8 million in the previous year, reaching a range between €16.6 million and €17.4 million. Electricity volumes increased by 52% to 909 GWh in just 12 months. GAS volumes increased by 170%. In this financial year eVISO generated €2.6 million in cash (the NFP increased in one year from €8.9 million in June 2023 to €11.5 million), completed the headquarters with an investment of €4.6 million and started the buy-back process for €1.5 million. I continue to believe that eVISO’s Business Model, which in my opinion is unique in its kind in the panorama of listed utilities in Italy and Europe, is a solid and sustainable competitive advantage that has generated a triple-digit increase in first margin in just 12 months and that will continue to generate sustained growth rates.”

Lucia Fracassi, General Manager of eVISO, added: “The results achieved in this fiscal year demonstrate the resilience and solidity of our business model and IT infrastructure. We are very proud of the results achieved, also considering the challenging market context in which we operate. This result confirms eVISO’s ability to grow and adapt effectively to daily situations, continuing to generate cash and strengthening its competitiveness. I would like to close by underlining that we have also entered the Gas sector, which we consider a strategic area with high growth potential and in which we believe we can have positive returns in terms of volumes and margins.”

KPI BY BUSINESS SEGMENT

NUMBER OF USERS AND COLLECTION POINTS

The total number of 12-month rolling electricity and gas users served stands at 545 thousand, up 35% compared to the 403 thousand users served in the period July 2022 – June 2023. In order to improve the quality of information, the company has decided to replace the 12-month rolling user number indicator – used to assess internal operating capacity – with a new indicator that measures the collection points served in the month, in line with data released by other operators in the energy sector. This indicator considers each collection point only once, regardless of any changes in the owner, company name and contract.

In addition, this indicator allows for better visibility into the size of the number of eVISO collection points in the market and the large growth opportunities.

In June 2024, there were 204 thousand electricity and gas collection points, up 35% compared to the 151 thousand collection points served in the period July 2022 – June 2023. As of December 2023, there were 181,000 collection points.

POWER

The number of associated resellers is substantially stable at 94, thus representing a share of 13.1% of the free-market sales operators registered in Italy (717) in the List of Electricity Sellers (EVE) drawn up by the Ministry of the Environment and Energy Security updated as of 06.30.2024.

The collection points (POD) on power customers in June 2024 were 201 thousand, of which 21 thousand direct and 180 thousand resellers. The collection points (POD) on power customers in June 2023 were 150 thousand, of which 16 thousand direct and 134 thousand resellers.

Total energy delivered increased by 52% to approximately 909 GWh (compared to the period July 2022 – June 2023), in line with the increase in the customer base, particularly in the reseller channel, the segment in which the greatest growth was recorded.

Specifically, the energy supplied to the reseller channel recorded a +60% to 614 GWh (compared to the period July 2022 – June 2023), while that addressed to the direct channel recorded a +39% to 295 GWh. The progressive improvement in the energy supplied in the financial year is attributable to the stabilization of the energy sector and the strengthening of eVISO’s commercial network to attract new customers in both segments.

GAS

In line with what was communicated in September 2023, eVISO has also started serving reseller customers in the gas segment.

Total gas delivered reached approximately 4.6 million scm (standard cubic meter) compared to 1.7 million scm as of June 30, 2023, up 170%. The majority of gas delivered is attributable to direct customers, as resellers have only recently entered eVISO’s customer portfolio.

The number of direct and reselling collection points (PDR) served in June 2024 is 3,466 (of which 96.8% direct), an increase of 85% compared to the approximately 1,872 withdrawal points served in June 2023.

ANCILLARY SERVICES

The ancillary practices subject to invoicing provided in the period July 2023 – June 2024 were over 50,000, an increase of +4% compared to the period July 2022 – June 2023 (approximately 49,000 practices).

Specifically, the most significant increases were recorded in the electricity channel where the ancillary services provided were 3,500, an increase of +75% (compared to the period July 2022 – June 2023) and in the gas channel where the ancillary services provided were 466, an increase of +96% (compared to the period July 2022 – June 2023).

FRESH APPLES

In the period July 2023 – June 2024, 127 tons of apples were delivered. The turnover settled at € 0.1 million, with an average revenue of € 984/ton.

In terms of product liquidity available on the SMARTMELE trading platform, as of June 30, 2024, the tonnes with limit orders on the platform were approximately 40,000, an increase of 34% compared to the approximately 30,000 tonnes recorded as of June 30, 2023.

***

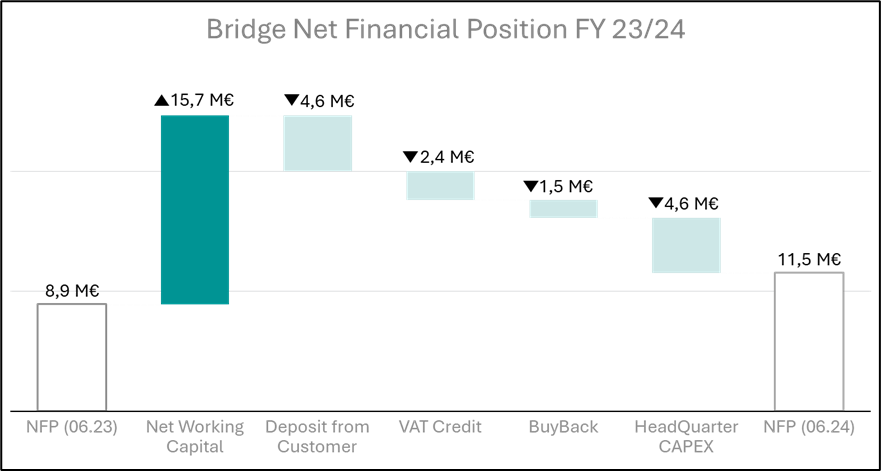

NET FINANCIAL POSITION

The Net Financial Position is positive (cash) for €11.5 million, compared to a positive Net Financial Position of approximately €5.4 million (cash) at 31 March 2024 and positive for €8.9 million at 30 June 2023.

The NFP from June 30, 2023 to June 30, 2024 was affected as follows:

- positively by €15.7 million related to the improvement in working capital;

- negatively by the reduction of €4.6 million in security deposits, following the realignment of guarantee requests to the price of energy;

- negatively by €2.4 million in VAT credit;

- negatively by the increase in buyback activity of approximately €1.5 million;

- negatively by the increase of €4.6 million related to the investment in the property owned.

For ease of reading, the graph below represents the elements that contributed to the change in the Net Financial Position in the period, in positive terms in case of cash generation and in negative terms in case of cash absorption.

Additionally, the NFP from March 31, 2024 to June 30, 2024 was affected as follows:

- positively by €6.3 million related to the improvement in working capital;

- positively by the increase of €0.3 million in security deposits, following the realignment of guarantee requests to the price of energy;

- positively by €0.7 million in VAT;

- negatively by the increase in buyback activity of approximately €0.2 million;

- negatively by the increase of €0.9 million related to the investment in the property owned.

***

Below is a table summarizing the main KPIs for the period July 2023-June 2024.

***

The above data are of a management nature and are not subject to audit. The complete economic-financial data will be published, as per the Company’s financial calendar, following the relative approval by the Board of Directors, scheduled for Wednesday, September 25, 2024.

The Company will illustrate the preliminary financial data to the financial community via conference call on Wednesday, September 4, 2024 at 11:00 CET.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.