15 May 2024, 15:27

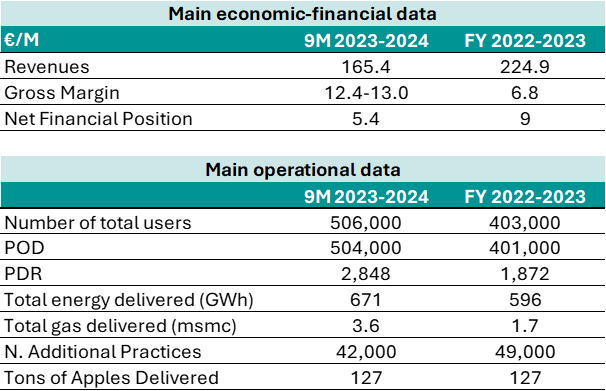

Preliminary 9 months FY23-24 Gross Margin between €12.4 million and €13.0 million • Total energy supplied equal to 671 GWh • Total gas supplied equal to 3.6 million cubic metres • Net Financial Position (cash positive) at €5.4 million • Rolling customer base over 12 months exceeds half a million units (+26% YOY)

DOWNLOAD THE PDF

Saluzzo (CN), 15 May 2024 – eVISO S.p.A. (simbolo: EVISO) – COMMOD-TECH company, listed on the EGM, with a proprietary artificial intelligence infrastructure that operates in the raw materials sector (electricity, gas, apples) – communicates the main KPIs and revenues relating to the 9 months of the period July 2023-March 2024, not subject to audit.

It should be noted that since this is the first voluntary communication of data on a quarterly basis, for comparison purposes, the company has identified the 12 months of the previous fiscal year (July 2022 – June 2023) as a significant reference period already communicated, with all the conditions of the case related to the comparison of 9 months compared to 12 months.

In the first 9 months of 2023-2024, the positive trend that characterized the performance of eVISO in the first part of the financial year continued. The customer base (rolling over the previous 12 months) is equal to 506 thousand (of which approximately 2,800 relating to the gas segment), an increase of 26% compared to the 403 thousand users managed by eVISO in FY22-23. Energy supplied through all channels reached 671 GWh, exceeding by almost 13% the 596 GWh supplied during the entire FY22-23 financial year. These factors contributed to the achievement of a preliminary Gross Margin of between €12.4 million and €13.0 million compared to a Gross Margin of €6.8 million recorded in the full financial year FY22-23. Revenues for the first 9 months of 2023-2024 amounted to €165.4 million compared to €224.9 million recorded in FY 22-23 and take into account the decrease in the average Single National Price (PUN) which in the nine months was was 110 €/MWh, a reduction of -56% compared to the average PUN recorded in the FY22-23 financial year of 247 €/MWh.

Gianfranco Sorasio, CEO of eVISO, commented: “We are satisfied with the results obtained in these first 9 months which highlight a notable increase in the volumes of energy and gas supplied and a significant increase in the Gross Margin generated. eVISO’s ability to generate cash remains an important competitive advantage in terms of cost and scale. The proprietary Artificial Intelligence platform allows us to manage an ever-increasing number of users with a marginal increase in management costs. The ongoing projects on the use of generative Artificial Intelligence, developed by third parties, and trained in a proprietary way on eVISO’s internal processes are generating confidence in the possibility of streamlining, speeding up and improving even the most administrative activities and therefore freeing the ground for growth even more important. From Friday 10 May 2024 the protected market has definitively ended in favor of the free market. I am confident that the competitive advantages built by eVISO will be able to best seize the growth opportunities of the coming months.”

Lucia Fracassi, General Director of eVISO, added: “The results at the end of March 2023 confirm the very positive trend already recorded at the end of December 2023 and for us this is a clear indication of the competitive advantage that eVISO has managed to build over time. Our internal teams have been able to best interpret the market dynamics and have been ready to face the challenges of complexity. We look to the future with renewed confidence, certain that our value proposition will be increasingly appreciated by our customers.”

KPIs BY BUSINESS SEGMENT RELATING TO THE PERIOD JULY 2023 – MARCH 2024

POWER

The total number of 12-month rolling users served stands at 504 thousand, up 26% compared to the 401 thousand users served in FY22-23, of which 33 thousand direct and 471 thousand managed by the 95 resellers combined with eVISO. The number of resellers represents a 15% share of the free market sales operators registered in Italy (693) in the Electricity Sellers List (EVE) drawn up by the Ministry of the Environment and Energy Safety updated as of 03.31.2024.

The total energy supplied was equal to 671 GWh, higher than the 596 GWh supplied in the entire FY22-23 financial year, of which 453 GWh related to the reseller channel (384 GWh in FY22-23) and 218 GWh aimed at the direct channel (213 GWh in FY22-23). The increase in energy supplied was positively influenced by the stabilization of the energy sector and the strengthening of eVISO’s commercial distribution network.

GAS

Consistent with what was communicated in September 2023, eVISO also began serving reseller customers in the gas segment.

The total gas supplied reached approximately 3.6 million smc (standard cubic metre) compared to 1.7 million smc for the entire FY22-23 financial year. Most of the gas supplied is attributable to direct customers, as resellers have only recently entered the eVISO customer portfolio.

The number of users served was 2,848 (rolling over the previous 12 months), an increase of 52% compared to the 1,872 points served in FY22-23.

ACCESSORY SERVICES

The ancillary practices subject to invoicing were approximately 42,000 compared to the approximately 49,000 ancillary practices provided in the entire FY22-23 financial year.

FRESH APPLES

In the first 9 months of 2023-2024, 127 tons of apples were delivered. Turnover stood at €0.1 million, with an average revenue of €994/tonne.

In terms of product liquidity available on the SMARTMELE trading platform, as of March 31, 2024, the tons with limit price orders on the platform were approximately 40,000, up 20 times compared to the 2,000 tons recorded on December 31, 2022.

***

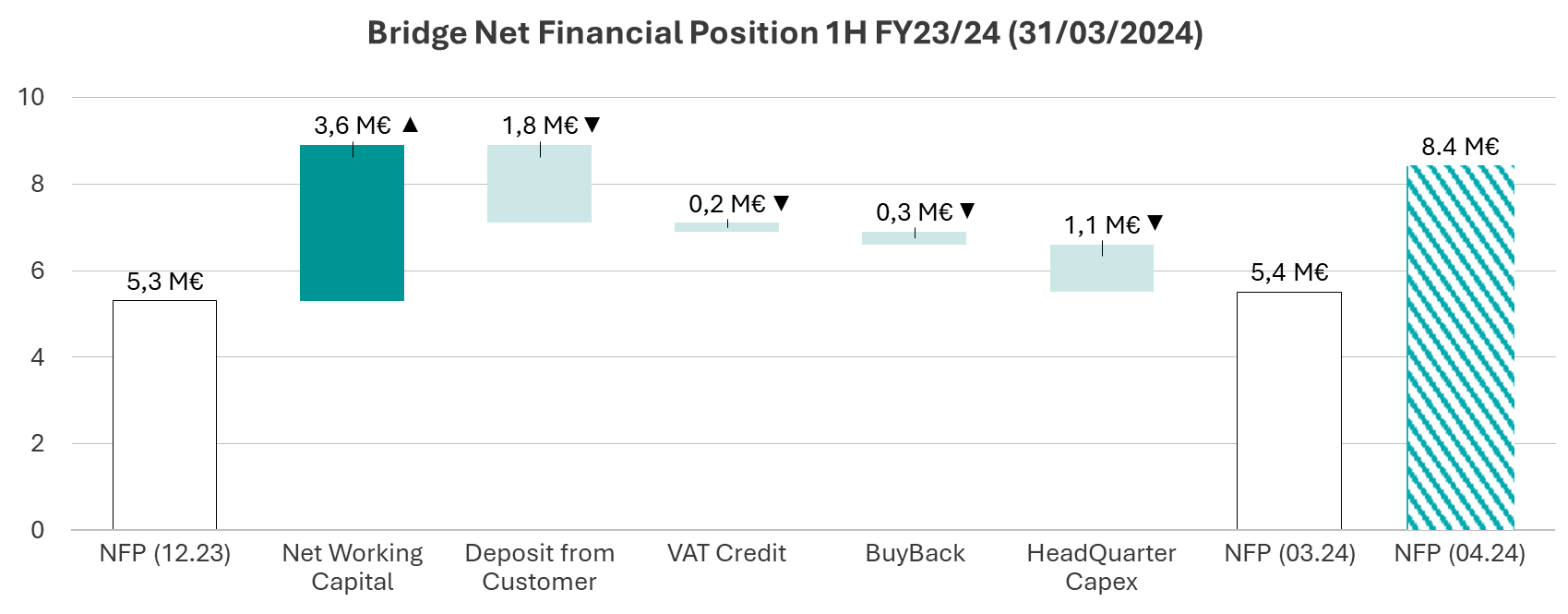

NET FINANCIAL POSITION

The Net Financial Position is positive (cash) for € 5.4 million, compared to a positive Net Financial Position of approximately € 9.0 million (cash) at 30 June 2023 and positive at € 5.3 million (cash) at 31 December 2023.

The NFP from 31 December 2023 to 31 March 2024 was affected as follows:

- positively by € 3.6 million relating to the improvement in working capital;

- negatively from the reduction of € 1.8 million in security deposits, following the realignment of guarantee requests to the price of energy;

- negatively by € 0.2 million of VAT credit;

- negatively by the increase in buyback activity of approximately € 0.3 million;

- negatively by the increase of € 1.1 million relating to the investment in the property owned.

It should be noted that the Net Financial Position at 30 April 2024 settled at €8.4 million (cash), an increase of €3.0 million compared to 31 March 2024. The improvement was influenced by the extraordinary repayment by Terna of €1.0 million security deposit, replaced by a first demand bank guarantee, and by the improvement of the Net Working Capital associated with direct customer and reseller collections pertaining to March 2024.

For ease of reading, the graph below represents the elements that contributed to the change in the Net Financial Position in the period, in positive terms in the case of cash generation and in negative terms in the case of cash absorption.

***

Below is a table summarizing the main KPIs for the period July 2023-March 2024.

***

We would like to inform you that the works for the construction of the new eVISO headquarters have been completed, for a total investment of €10.4 million from FY 19/20 to date.

The inauguration of the new headquarters will be held on May 18, 2024.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.