14 May 2025, 09:16

DOWNLOAD THE PDF

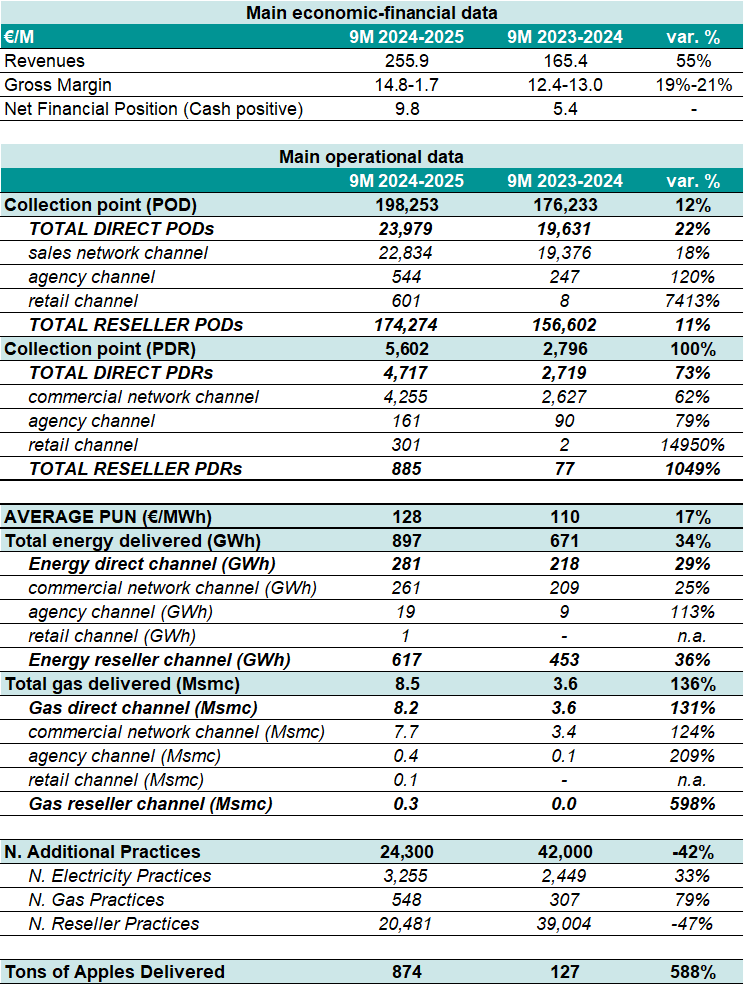

REVENUES AT €255.9 MILLION, UP 55% YoY

- Total energy supplied equal to 897 GWh, +34% YoY

- Total gas supplied equal to 8.5 million smc, +136% YoY

- Preliminary gross margin between € 14.8 million and € 15.7 million (+19% -21% YoY)

- Total collection points equal to 204 thousand, +14% YoY

- Net Financial Position (cash positive) equal to € 9.8 million, compared to a PFN (cash positive) equal to € 11.3 at 31 December 2024

Saluzzo (CN), 14 May 2025 – eVISO S.p.A. (simbolo: EVISO) – COMMOD-TECH company, listed on the EGM, with a proprietary artificial intelligence infrastructure that operates in the raw materials sector (electricity, gas, apples) – communicates the main KPIs and revenues for the 9 months of the period July 2024–March 2025, not subject to audit.

In the first nine months of the financial year (July 2024 – March 2025), the company recorded record revenues of €255.9 million, up 55% compared to the same period of the previous year.

The performance was supported by the expansion of volumes across all channels and the slight increase in the costs of energy raw materials. All the company’s relevant indicators recorded strong growth numbers, in continuity with the trend observed in previous periods.

Volumes supplied grew across all channels and raw materials: energy reached 897 GWh (+34%), while gas supplied stood at 8.5 million smc (+136%). The number of total collection points (POD) reached 204 thousand, with a growth of 14% compared to the period July 2023 – March 2024, confirming the solidity of the development trajectory.

These results contributed to generating a Gross Margin between €14.8 million and €15.7 million, growing between 19% and 21% compared to the period July 2023 – March 2024.

Gianfranco Sorasio, CEO of eVISO, commented: “Cumulative turnover since eVISO was founded in 2013 exceeded one billion euros at the end of 2024, a solid milestone that reflects eVISO’s industrial capacity to provide products and services on a national scale. In the last 9 months, eVISO’s turnover reached 255 million euros, up 55% compared to the same period of the previous year. The First Margin of the last 9 months increased by 20%, settling in a window between 14.8 M€ and 15.7 M€”.

Lucia Fracassi, General Manager of eVISO, added: “The commercial development strategies strengthened in recent years, and further accelerated in recent months, have led to a substantial growth in power and gas volumes in the channels managed by the company: direct sales through a sales network of consultants and wholesale sales through the reseller channel. The significant increases in these channels recorded in the last 9 months, +34% on the power side (to 897 GWh) and +136% on the gas side (to 8.5 million smc), are also starting to show the results of the most recent sales channels inserted in the last 12 months: retail channel and indirect sales channel through agencies, power and gas. Added to these results are the skills of the team of professionals who work every day in eVISO to better satisfy customers and develop faster, more scalable and competitive technological platforms”.

KPI BY BUSINESS SEGMENT FOR THE PERIOD JULY 2024 – MARCH 2025

POWER

The collection points (POD) recorded an increase of +12% (compared to the 176,233 PODs managed in the period July 2023 – March 2024) reaching 198,253, of which 24 thousand direct and 174 thousand managed by the 99 resellers associated with eVISO. The number of resellers represents a share of approximately 14% of the total free market sales operators registered in Italy (730) in the List of Electricity Sellers (EVE) drawn up by the Ministry of the Environment and Energy Security updated as of 03.31.2025. Furthermore, the total number of PODs includes a share of retail customers (601 PODs) almost 100 times higher than the same period of the previous year and 3 times higher than the approximately 200 points in supply in the six-month period July – December 2024, in line with the company strategy to penetrate this segment as well.

The total energy supplied is equal to 897 GWh, up 34% compared to the 671 GWh of the period July 2023 – March 2024, of which 617 GWh related to the reseller channel (453 GWh in the period July 2023 – March 2024) and 281 GWh addressed to the direct channel (218 GWh in the period July 2023 – March 2024). The increase in energy supplied was positively influenced by the strengthening of the eVISO commercial distribution network.

GAS

Total gas supplied reached approximately 8.5 million smc (standard cubic meter), up 136% compared to 3.6 million smc in the period July 2023 – March 2024. Most of the gas supplied is attributable to direct customers, as resellers have only recently entered eVISO’s customer portfolio.

Total collection points (PDR) are equal to 5,602 and have recorded an increase of +100% compared to the 2,796 PDRs managed in the period July 2023 – March 2024. 84% of the PDRs recorded in the period are attributable to direct customers.

ANCILLARY SERVICES

The ancillary practices subject to invoicing were approximately 24,300 compared to the approximately 42,000 ancillary practices provided in the period July 2023 – March 2024. The reduction in practices towards the reseller channel is attributable, as already communicated, to the resolution, introduced from 1 December 2023, where ARERA, the sector authority, has established that the most frequent practices must be managed independently by the commercial counterpart (reseller).

FRESH APPLES

In the first 9 months of 2024-2025, 874 tons of fresh and processing apples were delivered (+588% YoY). The turnover settled at over € 0.2 million (+91% YoY).

On October 14, 2024, eVISO signed an agreement with Seed Group, a company of the Private Office of Sheikh Saeed bin Ahmed Al Maktoum, aimed at expanding the Smartmele project on a global scale, starting from the Gulf countries. Furthermore, as part of this agreement, the company Smartmele Fruits Trading L.L.C. was established at the beginning of March 2025, 100% owned by eVISO with registered office in Dubai.

***

NET FINANCIAL POSITION

The Net Financial Position is positive (cash) for € 9.8 million, compared to a positive Net Financial Position of approximately € 11.5 million (cash) at 30 June 2024 and positive at € 11.3 million (cash) at 31 December 2024.

The following are the main factors that generated and absorbed cash from 31 December 2024 to 31 March 2025:

- reduction of active security deposits by customers € -0.6 million

- buyback € -0.1 million

- investment in the property owned € -0.2 million

- annual adjustment for excise duties € -1.5 million

- VAT effect for € 0.7 million

***

Below is a table summarizing the main KPIs for the period July 2024 – March 2025.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.