14 February 2024, 12:20

READ THE PRESS RELEASE

Preliminary half-year gross margin between €8 million and €8.4 million (about 4X YoY)

- Total energy delivered equal to 431 GWh, up 49% YoY

- Total gas delivered equal to 1.6 million smc, up 179% YoY

- Net Financial Position (cash positive) at €5.3 million

- Customers served exceed 400 thousand units, +66% YoY

Quantitative and qualitative criteria approved for the purposes of assessing the independence of directors

Implementation methods for launching the “buy-back” program approved

The transfer of the registered office of the company has been approved

Saluzzo (CN), 14 February 2024 – the Board of Directors of eVISO S.p.A. (simbolo: EVISO) – COMMOD-TECH company, listed on the EGM, with a proprietary artificial intelligence infrastructure that operates in the raw materials sector (electricity, gas, apples) – meeting today, examined the main KPIs and revenues relating to the 1st half of July-December 2023, not subject to legal audit.

The six-month period set historical records in terms of volumes of energy delivered across all channels (+49% YoY to 431 GWh) and in terms of gross margin, which, based on current preliminary results, was in the € 8 million and € 8.4 million window, up by almost 4X compared to € 2.2 million in the same half of the previous year, and up by more than 18% compared to the first full-year margin July 2022-June 2023 (€ 6.7 million).

Total energy volumes delivered grew by 63% in the reseller channel (to 297 GWh) and by 25% in the direct channel (to 134 GWh). The volumes of gas supplied to the more than 2,118 users served in the direct channel grew to 1.6 million smc (+179% YoY).

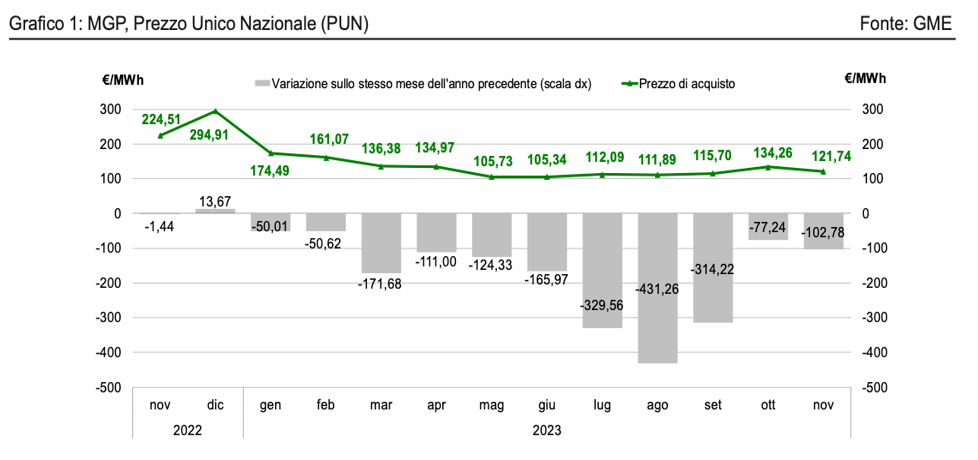

In the face of a 67% reduction in the price of energy compared to the same half of the previous year (from €358/MWh recorded in the six months of July-December 2022 to €119/MWh), revenues in the six months of July-December 2023, amounting to €109 million, fell by 25%. The graph below shows the strong variation of the PUN (Single National Price) over the same month of the previous year (Source: GME).

Lucia Fracassi, General Manager of eVISO, commented: “The figures for the half year just ended are the best recorded in eVISO’s history. Compared to the same half-year last year, the company increased both the volumes delivered (49%) and the gross margin per unit of energy (€/MWh). As a result of this double increase, preliminary figures indicate that the first half-year margin will be between € 8 million and € 8.4 million, about four times the first half-year margin of last year (€ 2.2 million).”

Gianfranco Sorasio, CEO of eVISO, commented: “The proprietary digital infrastructure launched by eVISO on the domestic market at the end of 2023 marks a unique competitive advantage over medium-sized Italian operators. The contracts finalised with Resellers in December 2023 (1250 GWh annual electricity pipeline), the growth rate on direct customers (+19% in two months, reported on 5.02.2024) and the +179% YoY on gas volumes are concrete indications that eVISO’s products are unique in the market and scalable on continuously growing volumes, also internationally”.

KPI BY BUSINESS SEGMENT

POWER

The total number of rolling 12-month users served stands at 399,000, up 66% from the 240,000 users served in 2022, of which 31,000 were direct users and 368,000 managed by the 94 resellers associated with eVISO. The number of matched resellers remained stable at 94, thus representing a share of 13.5% of the free market sales operators surveyed in Italy (695) in the Electricity Energy Vendors List (EVE) compiled by the Ministry of the Environment and Energy Security updated as of 31.01.2024.

Total energy delivered increased by 49% to about 431 GWh (compared to the same half-year in 2022), consistent with the increase in the customer base, particularly in the reseller channel segment where the greatest growth was recorded.

Specifically, energy delivered to the reseller channel was up 63% to 297 GWh (compared to the same half-year in 2022) and energy delivered to the direct channel was up 25% to 134 GWh. The gradual improvement in the energy delivered in the past six months is attributable to the stabilisation of the energy sector and the strengthening of eVISO’s sales network.

GAS

Consistent with its announcement in September 2023, eVISO also started serving reseller customers in the gas segment.

Total gas delivered reached approximately 1.6 million smc (standard cubic metres) compared to 0.6 million smc as at 31 December 2022, an increase of 179%. Most of the gas delivered is attributable to direct customers, as resellers have only recently entered eVISO’s customer portfolio.

The number of users served was 2,118 (rolling over the previous 12 months), an increase of 46% compared to the approximately 1,452 points served in the same six months of the previous year.

ANCILLARY SERVICES

The number of ancillary dossiers subject to invoicing disbursed in the semester was 33,000, an increase of +46% compared to the same period of the previous year (23,000 dossiers). Specifically, the most significant increases were recorded in the reseller channel where the ancillary services disbursed were 32,000, up +45% (compared to the same six months of 2022) and in the gas channel where the ancillary services disbursed were 182, up +102% (compared to the same six months of 2022).

FRESH APPLES

In the six-month period, 106 tonnes of apples were delivered. The turnover stood at € 0.1 million, with an average revenue of € 984/tonne.

In terms of product liquidity available on the SMARTMELE exchange platform, there were approximately 40,000 tonnes with limit orders on the platform as at 31 December 2023, a 20-fold increase from the 2,000 tonnes recorded on 31 December 2022.

***

NET FINANCIAL POSITION

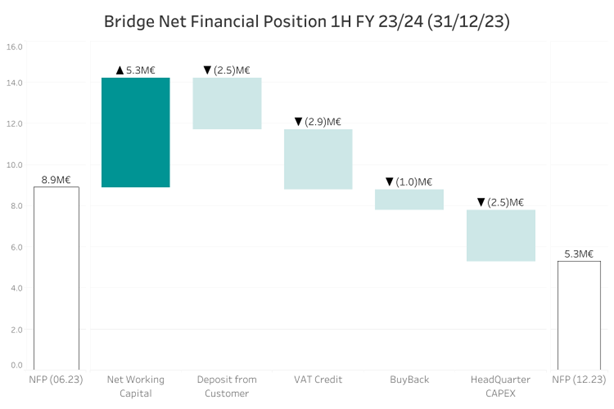

The Net Financial Position was positive at € 5.3 million (cash), compared to a positive Net Financial Position of about € 9 million (cash) as at 30 June 2023 and negative at € 4 million (debt) as at 31 December 2022.

The NFP from 30 June 2023 to 31 December 2023 was affected as follows:

- positively by € 5.3 million related to the improvement of working capital, of which € 3.9 million was due to the payment on account of resellers;

- negatively by the reduction of €2.5 million in security deposits, following the realignment of guarantee claims to the energy price;

- negatively by € 2.9 million VAT credit, of which € 1.8 million VAT refund collected in January 2024;

- negatively impacted by the increase in buyback activity of about € 1 million;

- negatively by the increase of €2.5 million related to the investment in the property.

For ease of reading, the graph below represents the elements that contributed to the change in the Net Financial Position during the period, in positive terms in the case of cash generation and in negative terms in the case of cash absorption.

***

IMPLEMENTATION MODALITIES FOR THE LAUNCH OF THE ‘BUY-BACK’ PROGRAMME APPROVED

Furthermore, also on today’s date, eVISO S.p.A. announces that in execution of the authorisation granted by the Shareholders’ Meeting of 27 October 2023, the Company’s Board of Directors approved the implementing procedures for the launch of a share buyback programme, for a number of shares not exceeding 10% of the Company’s pro-tempore share capital.

It is noted that the Company, based on data available as of 9 February 2024, holds 545,269 treasury shares, representing 2.21% of the share capital.

The shares thus purchased may be used, in accordance with the shareholders’ resolution of 27 October 2023, (i) to dispose of treasury shares to service any future incentive plans in favour of members of the board of directors, employees or collaborators of the company that imply the disposition or assignment of shares or financial instruments convertible into shares, (ii) to dispose of a securities portfolio (so-called “securities warehouse”) to be used, consistent with the strategic guidelines of the Company, for any extraordinary transactions and/or the possible use of shares as consideration in extraordinary transactions, including share swaps, with other parties within the scope of the Company’s strategic guidelines, in order to service any extraordinary transactions, including shareholding swaps, with other parties within the scope of the Company’s strategic guidelines. securities portfolio) to be used, consistently with the Company’s strategic guidelines, to service any extraordinary transactions and/or the possible use of the shares as consideration in extraordinary transactions, including share swaps, with other parties in the context of transactions of interest to the Company, and (iii) to pursue an efficient use of the liquidity generated by the Company’s core business also through medium- and long-term investments in treasury shares.

Pursuant to Article 2357(1) of the Italian Civil Code, the purchase of treasury shares must be made within the limits of the distributable profits and available reserves resulting from the last duly approved financial statements and, when purchasing or disposing of, exchanging, transferring or devaluing shares, the appropriate accounting entries will be made, in compliance with the law and applicable accounting principles.

Purchases must be made in compliance with the price limits indicated in the laws and regulations in force at the time, (i) at a price that does not deviate downwards or upwards by more than 20% from the reference price recorded by the share in the stock exchange session on the day prior to each individual transaction, and in any case (ii) at a price that does not exceed the higher of the price of the last independent transaction and the price of the highest current independent purchase offer on the trading venue where the purchase is made.

No purchase may be made on any trading day in excess of 25% of the average daily volume of shares on the trading venue where the purchase is made over the twenty trading days preceding the date of purchase.

The purchases will be commenced as soon as possible and compatibly with market conditions and will be carried out on Euronext Growth Milan, in compliance with the conditions set out in the resolution of the Shareholders’ Meeting of 27 October 2023, as well as in a manner that complies with the provisions of Regulation (EU) 596/2014 on market abuse and Delegated Regulation (EU) 2016/1052.

***

Notice is hereby given that today the Board of Directors of the Company – following the regulatory amendments to the Euronext Growth Milan Issuers’ Regulations introduced by Borsa Italiana S.p.A. with Notice No. 43747 published on 17 November 2023 – has defined the quantitative and qualitative criteria of significance of the relationships potentially relevant for the purpose of assessing the independence of its directors. These criteria are available to the public on the Company’s website www.eviso.ai in the “Governance” section.

The Board of Directors also approved the transfer of the registered office from Via Silvio Pellico 19 to Corso Luigi Einaudi 3, also within the municipality of Saluzzo (CN).

***

The above figures are of an operational nature and are unaudited. As per the Company’s financial calendar, the complete financial data will be published following its approval by the Board of Directors, scheduled for Thursday 28 March 2024.

The Company will present the preliminary financial data to the financial community via conference call on Thursday, 15 February 2024 at 11.00 a.m. CET.

***

This press release is available in the Investor Relations section of the website www.eviso.ai.

For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with headquarters Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions n. 22517 and 22518 of 23 November 2022.