31 August 2023, 18:18

Progressive improvement in all key indicators during the second half Net financial position at € 9 million (cash), € 13 millions of cash generated in the last six months Record of users served

DOWNLOAD THE PDF OF THE PRESS RELEASE

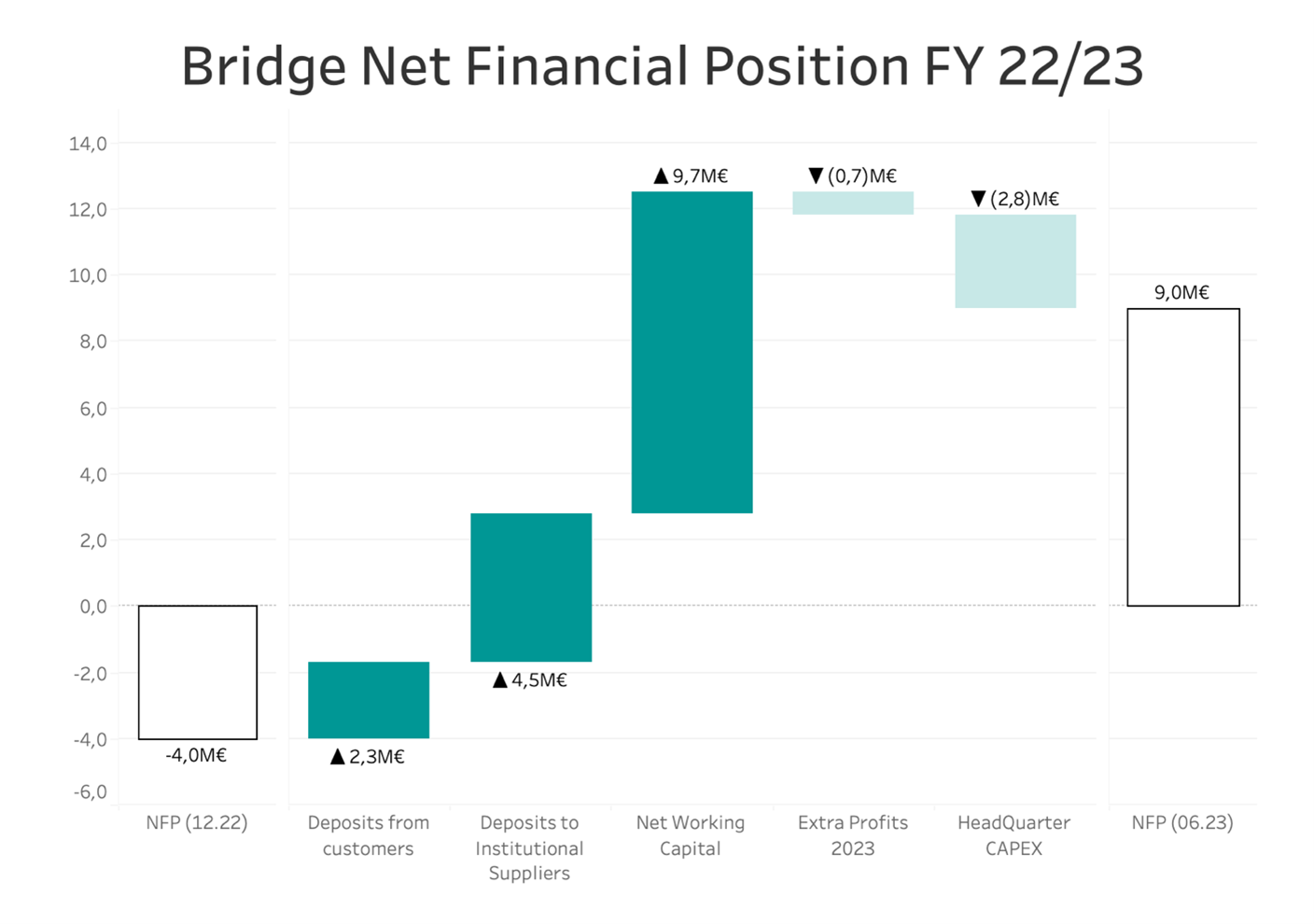

- Favorable cash cycle with Net Financial Position (cash) at € 9 million, an improvement of € 13 million (cash) compared to 31 December 2022 (negative Net Financial Position – debt – of €4 million).

- The number of users served in the electricity commodity reaches 401,000 (+100% YoY), with over 48,000 ancillary procedures processed (+79% YoY).

- Record annual revenues: € 225 million (+8% YoY).

Saluzzo (CN), August 31, 2023 – The Board of Directors of eVISO S.p.A. (symbol: EVISO) – a digital company, listed on the EGM, with a proprietary artificial intelligence infrastructure operating in the commodities sector (electricity, gas, apples) – gathered today to review the revenues for the period July 2022 to June 2023, not subject to legal review, and the key indicators.

eVISO’s growth trend continues, reaching revenues of € 225 million for the period July 2022 to June 2023, an 8% increase compared to the € 208 million of the previous period. The number of electricity users served has reached 401,000, doubled in just 12 months compared to 201,000, in line with the strategy of focusing on resellers on mainly small-sized users, also in view of the complete liberalization of the market confirmed for the end of 2023. The number of additional services invoiced to electricity and gas customers has reached 48,500 units, a 79% increase from the 27,000 services in the previous period.

eVISO’s technological DNA, based on a platform business model, demonstrated its strength in the second half of the fiscal year by achieving a positive Net Financial Position of € 9 million (cash), adding € 13 million in cash in just 6 months. This result assumes a strategic value of significant competitive advantage when read in a market context characterized by high interest rates and, for the “energy and gas” segment, also by high debt rates.

“The Fiscal Year – commented Gianfranco Sorasio, CEO of eVISO – recorded an extremely dynamic second half with the generation of € 13 million in cash. With this result, eVISO reversed the financial dynamics of the July-December 2022 semester marked by energy costs with unique peaks in recent history and adverse Italian legislative events. The momentum gained in the second semester January – June 2023 is the tangible result of our platform business model, capable of generating cash in countertrend to the Italian energy and gas sector. The strength of our cash cycle and virtually nonexistent financial debt work in eVISO’s favor in two distinct ways. First, they allow eVISO to avoid significant financial burdens in a high-rate environment, differentiating us from major Italian companies in the energy sector. Additionally, eVISO’s ability to attract new customers is enhanced by a favorable cash cycle, unlike other operators where indebtedness grows in parallel with business volume.

The just-concluded period therefore marks a clear turning point compared to the past, anticipating 18 months of strong and profitable growth. The year that has just ended, the full results of which will be approved on 26 September 2023, will instead be affected not only by the economic tensions recorded in the first half of the year, but also by a further tax on extra profits paid in the second half of the year (€ 0.7 million) and by the continuation of the blocking of the economic conditions applied to direct customers.”

ELECTRICITY

The fiscal year was characterized by two semesters with diametrically opposed dynamics in the Italian market. The average PUN (Single National Price) in the second semester (January – June 2023) was € 136/MWh, a decrease of 62% compared to the € 358/MWh recorded in the first semester (July – December 2022), which was characterized by unique price spikes in modern history. The average annual PUN was € 247/MWh, an increase of 14% YoY.

The company’s average revenue per MWh increased by 14% YoY, from € 284/MWh in the 2021/2022 period to € 324/MWh in the just-concluded period. In this case as well, the dynamics of the last two semesters were quite different, with the average revenue in the second semester at € 228/MWh, also due to the combination of relatively low PUN and network charges nearly eliminated by the government in the January-March quarter, and the average revenue in the first semester at € 426/MWh.

The total number of users served increased by 100% compared to the previous period, reaching 401,000, while the number of affiliated resellers with eVISO reached 98, a 27% increase from 77 as of 30 June 2022, representing 14.9% of authorized entities for the sale of electricity to final customers, updated as of 31 July 2023 (MASE – Ministerial Decree August 25, 2022, No. 164).

Total electricity delivered in the second semester amounted to 307 GWh, a 6% increase compared to the previous semester (290 GWh) and an 8% increase compared to the same semester of the previous year (284 GWh). The total annual electricity delivered was 597 GWh (-5% YoY). Electricity delivered to resellers in the segment amounted to 384 GWh (+1% YoY), while electricity delivered through direct sales channels amounted to 213 GWh (-14% YoY). This latter figure indicates a progressive improvement compared to the first semester (-21%), and it’s worth noting that the reduction in consumption through the direct channel is partially related to the higher switch-out recorded in a limited period of early 2022, and associated mainly with the time-limited attractiveness of few fixed-price offers.

GAS

The second semester witnessed a strong growth in the number of direct users, bringing the total annual number to 1,872, a 47% increase YoY, marking a clear acceleration compared to the stability of previous semesters.

Gas volumes reached approximately 1.7 million standard cubic meters (smc), a 5% increase compared to the 1.6 million smc in the previous period. Revenue decreased by 21% to € 1.8 million (compared to € 2.3 million in the previous period), and the average gas revenue marked a 25% YoY decrease, largely due to the suspension of network services decided by the government to combat high energy prices from late 2021 to early 2023.

APPLES

The fiscal year marked the transition of the SMARTMELE project into a phase of commercial scalability. SMARTMELE is the digital platform for international exchange of forward contracts of apple containers. eVISO is the sole owner of the SMARTMELE brand and of the whole digital assets.

In terms of deliveries, during the FY22/23 period a total of 127 tons of apples were for the first time dispatched, from Kuwait to Brazil. Revenue amounted to € 0.1 million, with an average revenue of € 873 per ton.

In terms of available product liquidity on the SMARTMELE exchange platform, as of 30 June 2023, tons with limit price orders on the platform reached 29,868, a 16-fold increase from the 1,342 tons registered on 30 June 2022. In terms of SMARTMELE platform’s competitive advantage compared to potential future trading marketplaces, it’s noteworthy that the total amount of limit price orders available for sale on SMARTMELE reached € 28 million by June 2023. This threshold already allows international and national buyers to find substantial volumes in the requested category of variety, size, and origin on the platform at any given time.

ANCILLARY SERVICES

The ancillary procedures subject to billing provided in the six-month period totaled 48,527, up by +79% compared to the same period in the previous fiscal year (27,044 services). Specifically, the greatest growth was recorded in the reseller channel, where provided ancillary services amounted to 46,289, a +90% increase (compared to the 24,371 in the FY21/22 period).

***

NET FINANCIAL POSITION

The Net Financial Position stands positive (cash) at € 9 million, compared to a negative Net Financial Position of approximately € 4 million (debt) as of 31 December 2022, and a positive € 8 million (cash) as of 30 June 2022. The improvement in the Net Financial Position was positively influenced by increased customer deposits (€ 2.3 million), the withdraw of deposits made by eVISO to institutional suppliers (cash-back of € 4.5 million), and a net improvement in net working capital (€ 9.7 million). The change in Net Financial Position was negatively influenced by the payment of extraordinary and non-deductible “extra-profit” contribution amounting to € 0.7 million and expenses for the construction of the new headquarters amounting to € 2.8 million.

For ease of reading, the chart below presents the elements that contributed to the change in Net Financial Position during the period, positive in case of cash generation and negative in case of cash absorption.

The Net Working Capital generated € 9.7 million, influenced by the following positive and negative factors:

Positive:

- € 5.5 million: recover of the extraordinary and transitory absorption recorded in December 2022, in which, abnormally compared to previous years, the energy price was high at the beginning of the month (€ 382/MWh on 1 December 2022), and lower at the end of the month (€ 193/MWh on 31 December 2022). As a result, the weekly energy payment cycle to institutional suppliers led to a timing difference at the end of the month.

- € 5.2 million: legislator reintroduction of the network charges in electric bills, starting from 1 April 2023, suspended by the government at the end of 2021 to support families and businesses during the high energy cost period. In Italy the network charges are collected with electric bills and paid around 30 days later.

- € 3.5 million: efficiency in the management of trade receivables (repayment plans, etc.) and gas pre-payment.

- € 2.5 million: advance payments by resellers, according to the new contractual conditions in effect from 1 January 2023.

Negative

- € 4.7 million: modification of billing and payment terms for reconciliation invoices issued by Terna S.p.A. for previous years (Terna anticipated the payments terms of 6 months).

- € 2.3 million: VAT credit associated with the reversal of the VAT cycle related to network charges, subject to VAT when billed to eVISO and exempt when billed by eVISO to resellers.

If the billing and payment terms for reconciliation invoices issued by Terna had remained unchanged from the past, the cash generation resulting from the Net Working Capital variation would have been € 14.4 million.

***

The above-mentioned data is of management nature and is not subject to accounting review. The full financial figures will be published following approval by the Board of Directors, scheduled for Tuesday, 26 September 2023, as per the Company’s financial calendar.

***

This press release was translated from original version in Italian using automatic digital tools. eVISO declines every responsibility due to translation inconsistencies.

This press release is available in the Investor Relations section of www.eviso.ai. For the transmission of Regulated Information, the Company uses the EMARKET SDIR dissemination system available at www.emarketstorage.com, managed by Teleborsa S.r.l. – with registered office in Piazza di Priscilla, 4 – Rome – following the authorization and CONSOB resolutions no. 22517 and 22518 of 23 November 2022.